- News

- Basics

- Products

- JP Job shop

- Exhibition

- Interview

- Statistic

- PR

- Download

- Special contents

News

February 15, 2023

Dr. Yoshiharu Inaba, Chairman of FANUC and JMTBA

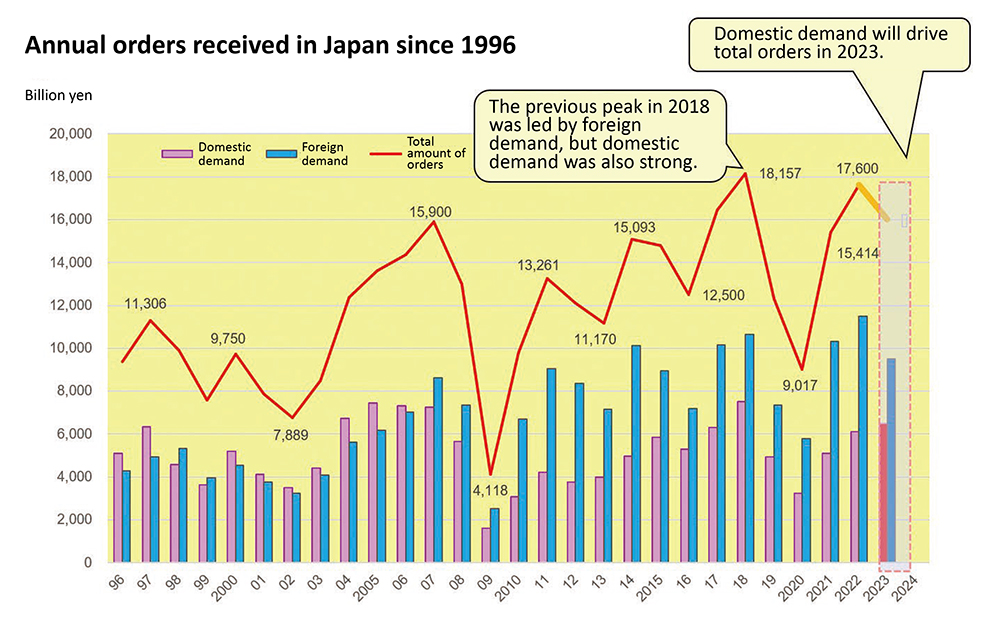

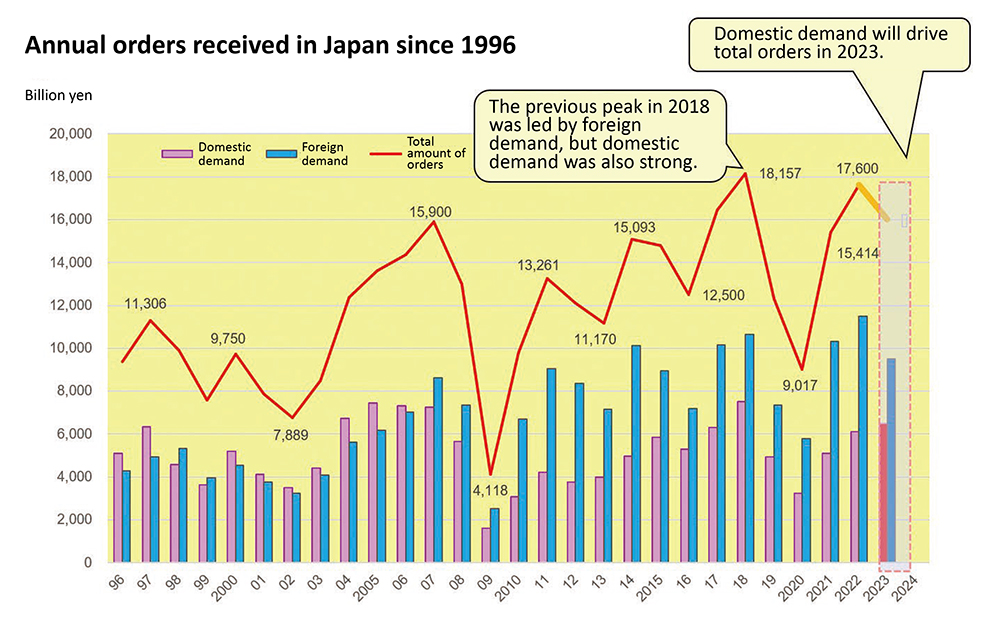

The Japan Machine Tool Builders’ Association (JMTBA) reported that total orders for machine tools in Japan reached 1.75 trillion yen in 2022, the level set in the annual forecast revised in September this year.

After bottoming out in May 2020, the recovery from the pandemic has continued. Although there were many risk factors in 2022, such as Russia’s invasion of Ukraine, the lockdown of the Shanghai area in China, and the re-emergence of the pandemic in Japan, demand related to semiconductors and electric vehicles (EVs) was strong.

As a result, foreign demand remained at the same level as in 2018, when annual orders were at a record high and exceeded 100 billion yen for three months in a row from March 2022. Domestic demand also remained at around 50 billion yen, supported by various subsidies. Dr. Yoshiharu Inaba, Chairman of FANUC and JMTBA, looks back: “The first half of 2022 was really a great year for us.”

However, after the middle of the year, the impact of monetary tightening in Europe and the U.S., as well as geopolitical risks, began to affect orders. There are signs that the market has bottomed out.

Therefore, JMTBA forecasts that total orders for machine tools in Japan in 2023 will be 1.6 trillion yen, down 8.6% from the previous year. The breakdown is as follows: domestic demand will increase by 8.3% to 650 billion yen, and foreign demand will decrease by 17.4% to 950 billion yen.

“If we can achieve this, it will be the fourth-highest level in history,” said Dr. Inaba. “The difference of 100 billion yen from News Digest Publishing’s forecast is the difference in the outlook for domestic demand,” he commented.

There are many positive factors for domestic demand. Investment in semiconductors is continuing, and investment in electric vehicles (EVs) and other vehicles, including those that are environmentally friendly, is also beginning to emerge. In addition, as was the case last year, expectations for various government subsidies are high.

On the other hand, foreign demand is expected to be affected by the economic slowdown, but investment appetite in Asian countries such as China and India, as well as in Europe and North America, is expected to be strong, especially for semiconductor-related products, automobiles, and telecommunication infrastructure-related products such as next-generation communication standards (5G).

In addition, the construction of production systems that reduce environmental impact to achieve carbon neutrality has begun around the world. Furthermore, social changes such as the Internet of Things (IoT), artificial intelligence (AI), and digital transformation are expected to provide a tailwind for capital investment.

Dr. Inaba stated, “Every year we ask two academic experts for their opinions, and this year their opinions were evenly split. This year’s forecast is so difficult to do. Even though we don’t know what will happen, we hope to make this a year that will lead steadily to next year.”

Will domestic demand be the driving force this year? / Source: Japan Machine Tool Builders’ Association

February 10, 2023

November 26, 2025

February 20, 2026