- News

- Basics

- Products

- JP Job shop

- Exhibition

- Interview

- Statistic

- PR

- Download

- Special contents

Statistic

February 6, 2025

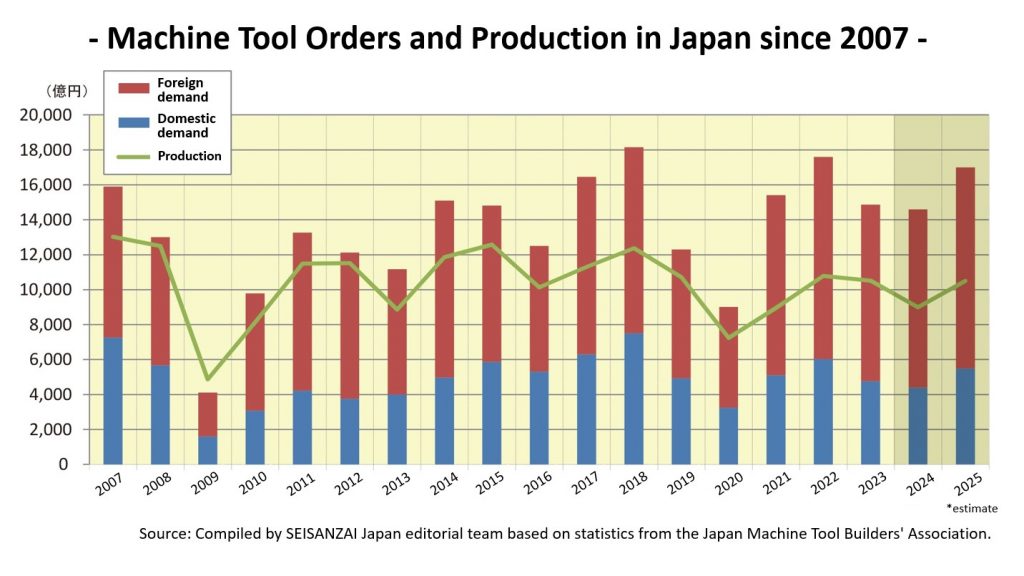

News Digest Publishing (ND), the organization behind SEISANZAI Japan, hosted the “2025 FA Industry New Year’s Reception” on January 10. During the event, SEISANZAI Japan Editor-in-Chief Dr. Shu Yasumi presented the industry outlook for Japan in 2025, forecasting total machine tool orders to reach 1.7 trillion yen, up 16.4% year-on-year (YoY).

Related article: 700 industry leaders gather for 2025 FA Industry New Year’s Reception

SEISANZAI Japan Editor-in-Chief, Dr. Shu Yasumi

In 2024, Japan’s total machine tool orders reached 1,485 billion yen, a slight decrease of 0.1% from the previous year. Dr. Yasumi noted that while domestic demand remained sluggish due to weak capital investment in key industries, foreign demand remained strong, supported by a weak yen. Although the overall market maintained a high monthly average of over 120 billion yen in new orders, many industry players perceived the business environment as challenging.

One of the main concerns was the lack of clear market trends. Traditionally, the automotive sector has played a stabilizing role for capital investment in the machine tool industry, but its investment direction remains uncertain. Looking ahead to 2025, however, he forecasts a significant recovery, estimating that total orders will increase by 16.4% to 1,700 billion yen, with:

・Domestic demand up 25.0% YoY to 550 billion yen

・Foreign demand up 12.7% YoY to 1,150 billion yen

Dr. Yasumi expects investment activity in key industries to pick up in the second half of the year, particularly in sectors such as automobiles and semiconductors, where previously delayed projects are likely to resume.

However, Dr. Yasumi pointed out that the expected acceleration of capital investment in Japanese industry in the second half will depend on nine key factors:

1. Continued yen depreciation

2. A drop in crude oil prices

3. Easing of U.S.-China tensions

4. Trump administration & “reshoring”

5. China’s economic stimulus

6. Ukraine peace process & reconstruction demand

7. Industrial growth in emerging markets

8. Broader investment beyond BEVs

9. AI-driven semiconductor investment

Dr. Yasumi explained that not all nine factors need to be in place for the 1,700 billion yen targets to be achieved. If at least half of these conditions are met, the forecast for a recovery in Japan’s machine tool orders remains realistic.

In conclusion, Dr. Yasumi warned that there are no longer stable markets, either geographically or across industry sectors. To survive and thrive, he stresses the need for new international expansion strategies.

“The time when Japan’s machine tool industry could simply follow CNC progress or expand with the globalization of the automotive sector is over,” he said. “There is no definitive answer to the right path forward, but companies must start preparing now to seize future opportunities.”

He acknowledged that uncertainty and struggle remain, but expressed optimism that the market will reach high levels of order activity in a year’s time.

The presentation materials (Japanese only) distributed at the event are available for free download from the News Digest Publishing website: www.news-pub.co.jp/newyearceremony/

January 29, 2025

January 28, 2025

December 5, 2025

October 8, 2025

December 18, 2025