- News

- Basics

- Products

- JP Job shop

- Exhibition

- Interview

- Statistic

- PR

- Download

- Special contents

Statistic

May 22, 2023

Click here for machine tool production and order results.

According to trade statistics from the Ministry of Finance of Japan, machine tool exports increased 20.3% YoY to 857.072 billion yen in 2022, while NC machines increased 20.3% YoY to 825.974 billion yen, both increasing for the second consecutive year.

By region, exports to Asia increased 6.1% YoY to 446.679 billion yen. Due to the slowdown in China, exports to Asia increased only slightly. Exports to North America increased 39.9% YoY to 226.672 billion yen, and exports to Europe increased 44.6% YoY to 166.226 billion yen, an increase of more than 30% YoY for the second consecutive year, mainly due to the easing of lockdowns and other restrictions caused by the COVID-19 pandemic, which stimulated economic activity. East Asia accounted for 38.4% YoY of Japan’s total exports, down 7.0 points from the previous year, but still the largest share for the second consecutive year. North America and Europe both increased their shares from the previous year, accounting for 26.4% YoY and 19.4% YoY, respectively.

By region, exports to Asia increased 6.1% YoY to 446.679 billion yen. Due to the slowdown in China, exports to Asia increased only slightly. Exports to North America increased 39.9% YoY to 226.672 billion yen, and exports to Europe increased 44.6% YoY to 166.226 billion yen, an increase of more than 30% YoY for the second consecutive year, mainly due to the easing of lockdowns and other restrictions caused by the COVID-19 pandemic, which stimulated economic activity. East Asia accounted for 38.4% YoY of Japan’s total exports, down 7.0 points from the previous year, but still the largest share for the second consecutive year. North America and Europe both increased their shares from the previous year, accounting for 26.4% YoY and 19.4% YoY, respectively.

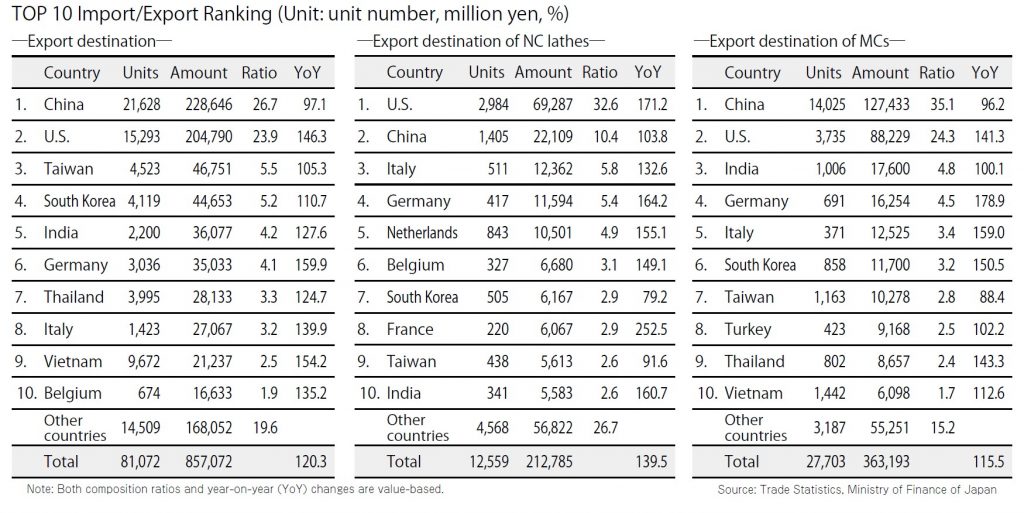

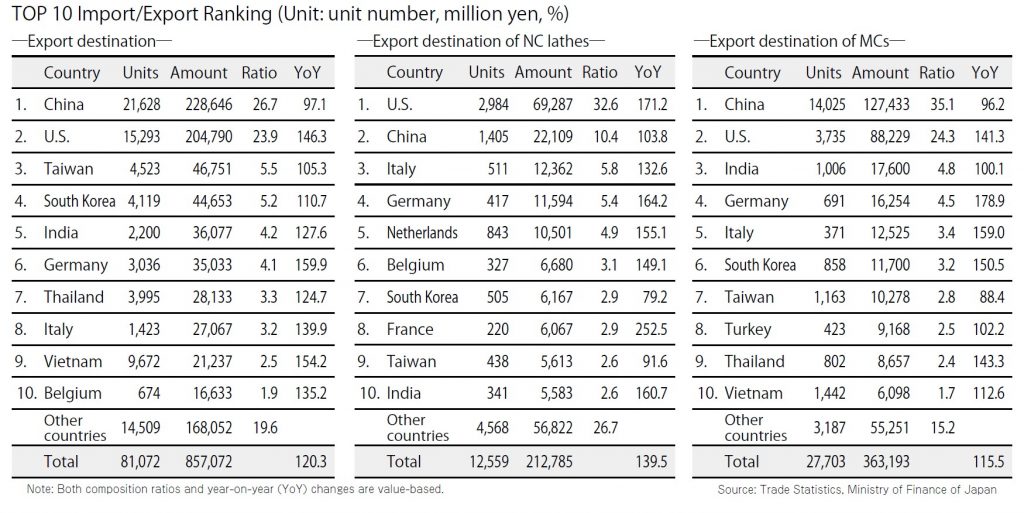

By country, exports to China took the top spot for the second year in a row, despite a 2.9% YoY decline to 228.646 billion yen, with the U.S. coming in second at 204.79 billion yen, up 46.3% YoY from the previous year. Taiwan, South Korea, and India ranked third, fourth, and fifth, respectively, with the top five remaining unchanged from the previous year.

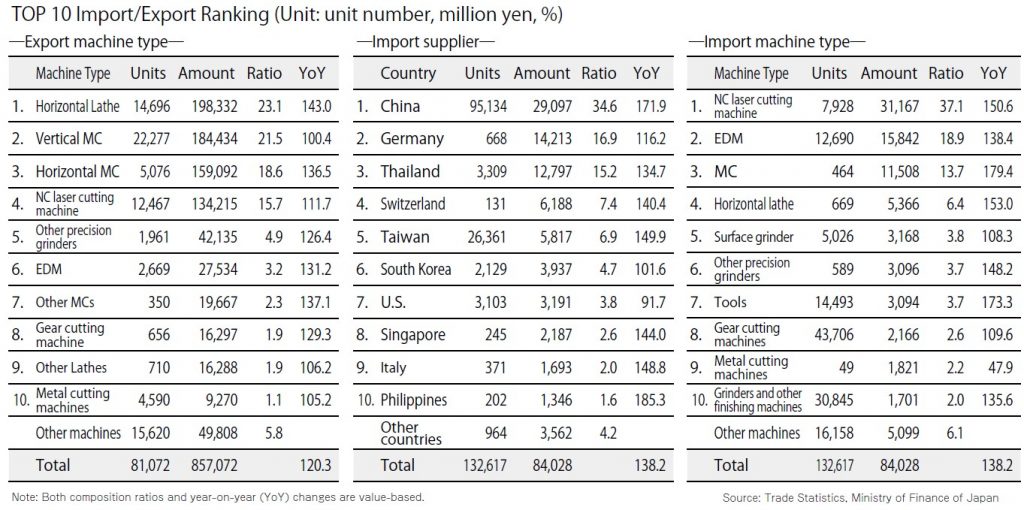

Exports by machine type showed that horizontal lathes increased significantly by 43.0% YoY to 198.332 billion yen, taking the top position for the first time in three years. Vertical MCs, which ranked first in the previous year, remained almost unchanged at 184.434 billion yen, up 0.4% YoY, and fell to second place. Vertical MCs also outperformed exports in 2019 due to increased demand for small machines for electronic equipment, where demand increased due to the pandemic. Total MCs grew 15.5% YoY to 363.194 billion yen, while lathes recorded an increase of 39.4% YoY to 214.6 billion yen.

As in the previous year, the U.S. was the top export destination for NC lathes, with China in second place. Germany, which ranked fifth in the previous year, jumped 64.2% YoY to 11.594 billion yen, moving up to fourth place.

The top three export destinations for MCs remained unchanged from the previous year, with China in first place, the U.S. in second, and India in third. Germany ranked fourth with 17.6 billion yen, up 78.9% YoY, and Italy ranked fifth with 12.525 billion yen, up 59.0% YoY. All European countries increased their figures from the previous year.

According to trade statistics from the Ministry of Finance of Japan, Japan’s machine tool imports in 2022 were up 38.2% YoY to 84.928 billion yen, exceeding 80 billion yen for the first time in three years, while NC machines were also up 41.7% YoY to 74.421 billion yen, accounting for 88.6% of total imports, a record high.

The top import supplier was China, up 71.9% YoY to 29.097 billion yen, followed by Germany, up 16.2% YoY to 14.213 billion yen, the same ranking as last year. Thailand followed in third place, with the top three countries accounting for more than 60% of total imports.

By type of machine, NC laser cutting machines took the top spot, up 50.6% YoY to 31.167 billion yen, followed by EDM machines, up 38.4% YoY to 15.842 billion yen, and MC machines, up 79.4% YoY to 11.508 billion yen.

Market conditions in Japan’s machine tool industry since the beginning of this year have continued the slowdown momentum that began in the second half of last year. According to the JMTBA, total orders for Japan’s machine tools fell 15.2% YoY to 141.016 billion yen in March, the third consecutive month of YoY decline.

Domestic demand fell 18.1% YoY to 49.365 billion yen in March. Foreign demand fell 13.6% YoY to 91.651 billion yen.

Although the market is recovering from the pandemic, the semiconductor shortage, rising raw material and transportation costs, the crisis in Ukraine and the U.S.-China trade dispute are still ongoing. In addition to these factors, inflation and the sharp rise in prices due to the weak yen are also major concerns. This year is likely to be one in which it will be even more important to take control of the sales side of the business.

December 5, 2025