- News

- Basics

- Products

- JP Job shop

- Exhibition

- Interview

- Statistic

- PR

- Download

- Special contents

Statistic

September 27, 2024

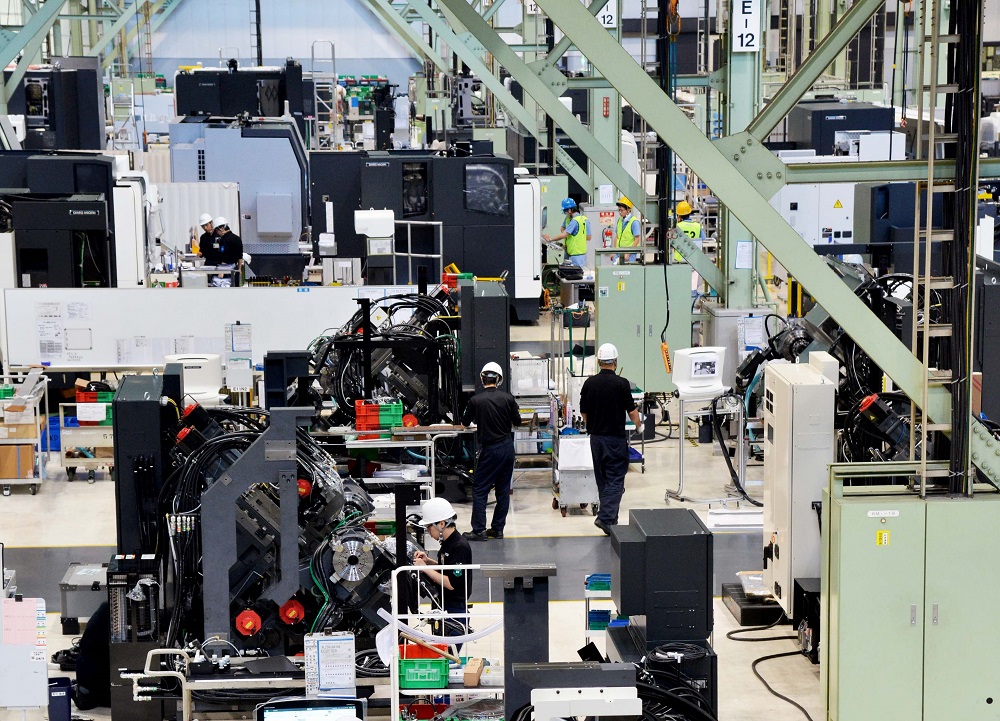

The Japan Machine Tool Builders’ Association (JMTBA) has released the final figures for Japan’s machine tool orders in August 2024, with orders totaling JPY 110.7 billion. This is the second consecutive month-on-month (MoM) decline and the first year-on-year (YoY) decline in four months. Influenced by the summer holiday season, both domestic and foreign orders declined from the previous month, bringing the total below JPY 120 billion for the first time in six months.

Domestic orders totaled JPY 32.1 billion, marking the second consecutive MoM decline and a 24-month streak of YoY declines. It also fell below JPY 35 billion for the first time in three months. Of the 11 industries, six posted MoM declines and seven posted YoY declines. Overall growth remained sluggish, with significant drops in industries such as metal products and electrical & precision machinery. Key industries such as Industrial Machinery and Motor Vehicles showed no signs of recovery.

Foreign orders totaled JPY 78.5 billion, the second consecutive monthly decline and the first MoM decline in four months. It was also the first time in 10 months that foreign orders fell below JPY 80 billion since October 2023 (JPY 78.4 billion).

Asia: Orders from Vietnam, which saw large-scale orders, and India, which remained strong, helped Other Asia exceed JPY 10 billion for the first time in two months. East Asia, including China, saw only a slight decline, keeping the total for Asia nearly the same as the previous month.

North America: The rebound from last month’s large orders in the Aircraft/Shipbuilding/Transport Equipment sectors, which boosted the previous month’s figures, led to a decline, bringing the total orders below JPY 25 billion for the first time in two months.

Europe: Orders from the EU showed a month-on-month decline, with the total falling below JPY 11 billion for the first time in 43 months since January 2021 (JPY 10.8 billion)

While August typically sees lower numbers due to summer holidays, this year’s decline in Europe and North America suggests that factors beyond seasonal trends may be at play. September’s results will be closely watched for further insight.

| Amount (million yen) | MoM change (%) | YoY change (%) | |

| Total Orders | 110,770 | 89.4 | 96.5 |

| Domestic total | 32,192 | 90.2 | 90.1 |

| Industrial Machinery | 14,777 | 95.4 | 101.6 |

| Motor Vehicles | 7,169 | 112.5 | 90.4 |

| Electrical & Precision Machinery | 2,613 | 50.1 | 51.3 |

| Aircraft/Shipbuilding/Transport equipment | 1,916 | 139.3 | 175.8 |

| Foreign total | 78,578 | 89.1 | 99.4 |

| Asia | 43,634 | 99.7 | 128.5 |

| Europe | 10,708 | 72.8 | 60.5 |

| North America | 22,980 | 85.3 | 92.7 |

Japan MT orders for

December 5, 2025

February 18, 2026