- News

- Basics

- Products

- JP Job shop

- Exhibition

- Interview

- Statistic

- PR

- Download

- Special contents

Statistic

November 30, 2022

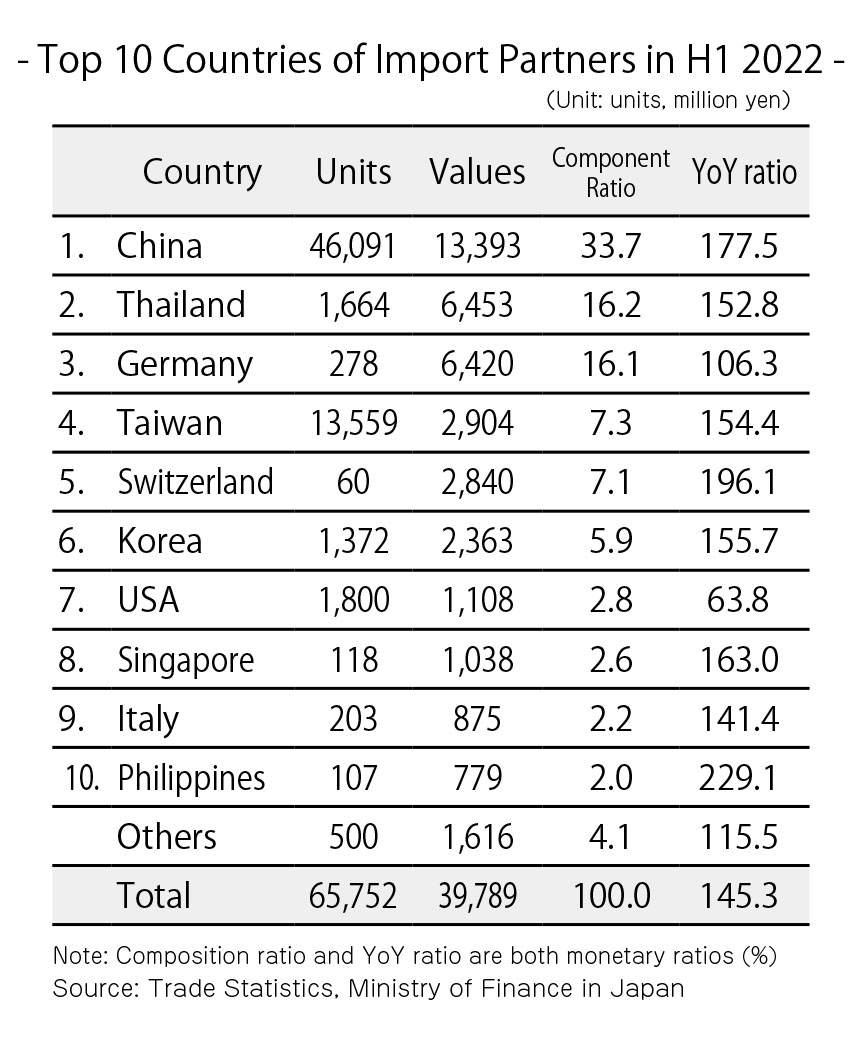

Japan’s machine tool imports in the first half of 2022 increased significantly by 45.3% year-on-year (YoY) to 39.789 billion yen. The number of machines imported fell 10.4% YoY to 65,752 units. Japan has been importing a large number of non-NC machines, with non-NC machines accounting for 86.0% of total imports in the first half of 2022.

Japan’s machine tool imports in the first half of 2022 increased significantly by 45.3% year-on-year (YoY) to 39.789 billion yen. The number of machines imported fell 10.4% YoY to 65,752 units. Japan has been importing a large number of non-NC machines, with non-NC machines accounting for 86.0% of total imports in the first half of 2022.

By monetary value, the top 10 importing countries remained unchanged from the same period last year. While China stayed at the top, Germany and Thailand reversed their rankings from the previous year, with Thailand coming in second.

By type of machine, there was an overall upward trend, particularly for MCs and lathes, with a significant increase over the same period of the previous year.

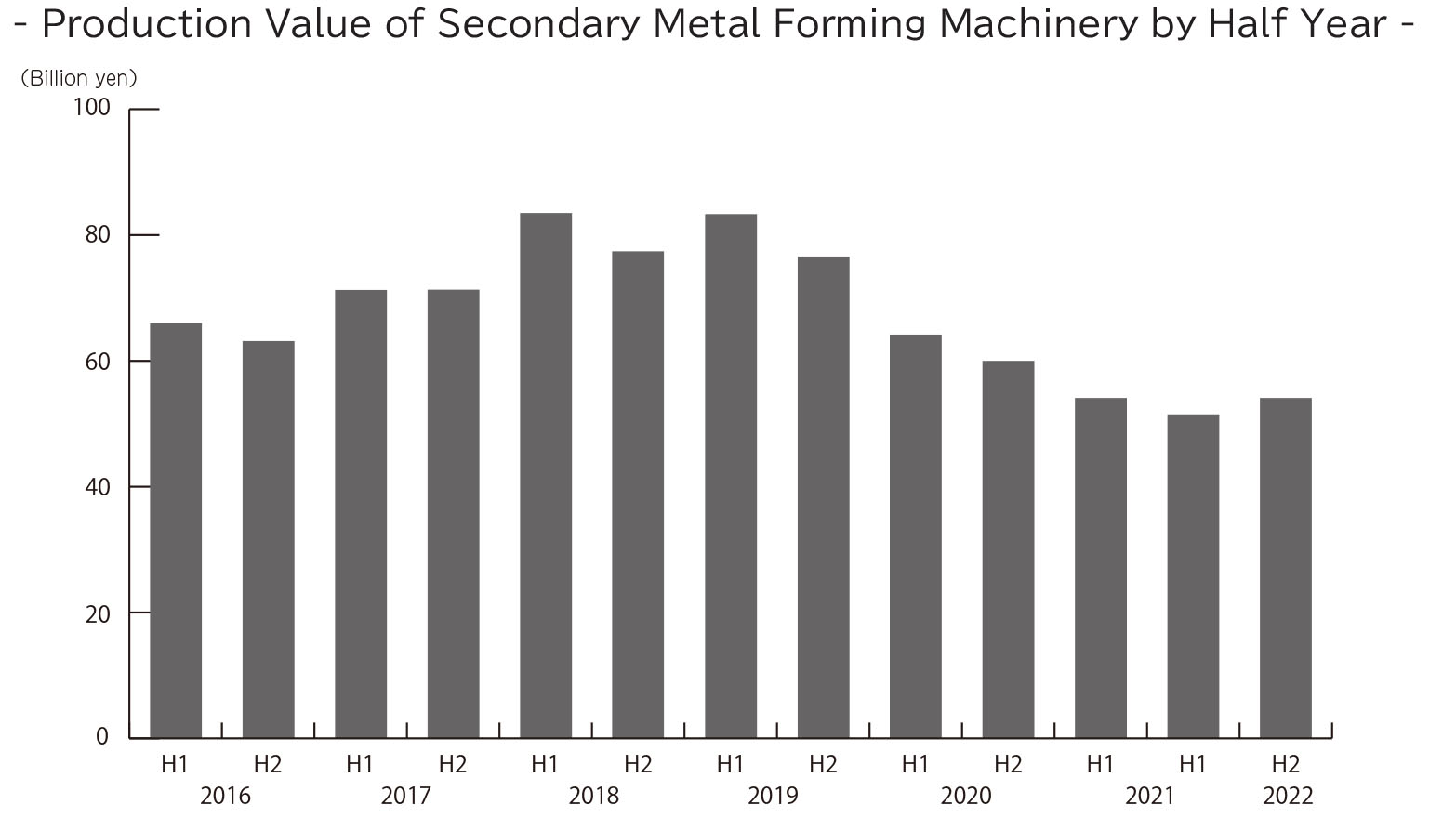

According to the Ministry of Economy, Trade and Industry in Japan, production of secondary metal forming machinery, such as presses and bending machines, increased slightly to 54.879 billion yen in the first half of 2022, up 2.5% from the same period of the previous year. Production increased 13.9% YoY to 2,516 units.

According to the Ministry of Economy, Trade and Industry in Japan, production of secondary metal forming machinery, such as presses and bending machines, increased slightly to 54.879 billion yen in the first half of 2022, up 2.5% from the same period of the previous year. Production increased 13.9% YoY to 2,516 units.

By machine type, production of bending machines and wire forming machines increased YoY, but overall production stayed generally flat.

The Japan Forming Machinery Association (JFMA) announced that the total amount of orders received for forming machines (press machines, sheet metal machines, services, etc.) in the first half of 2022 increased by 31.9% YoY to 194,676 million yen.

For the sixth consecutive month since the beginning of the year, orders for press-related machinery increased 38.7% YoY to 82,259 million yen, and those for sheet-metal machinery increased 51.7% YoY to 68,651 million yen.

Given the latest order situation, JFMA has revised upward its forecast for total amount of orders in 2022 from the initial 340 billion yen to 384 billion yen.

Many countries around the world are moving out of the stagnation caused by the pandemic. In addition, the rebound from the stagnation has led to robust corporate demand for capital investment, and the total amount of machine tool orders in the first half of 2022 exceeded that of the same period of the previous year.

The strong growth in orders has also carried over into the second half of the year and beyond, with July orders up 5.5% YoY to 142,412 million yen, August orders up 10.7% YoY to 139,327 million yen, and September orders up 4.3% YoY to 150,820 million yen.

Given these results, JMTBA revised upward its forecast for the total amount of orders in 2022 from the initial 1.65 trillion yen to 1.75 trillion yen.

In September, IMTS2022 was held in the US, and at the beginning of November, the 31st Japan International Machine Tool Fair (JIMTOF2022) was held in Japan. The first time in four years that these two major machine tool fairs have been held in-person, orders are expected to gain further momentum in the second half of the year and beyond.

However, there are various risk factors at hand, such as shortages of semiconductors and components, and rising transportation costs. Prolonged delivery times due to these factors will lead to lost business opportunities.

Both orders and production are currently strong, but responding to unexpected risks such as supply chain disruptions due to geopolitical risks and the yen’s depreciation will also be key issues to be addressed.